Turn Your Cash Cyclemoneyco Around: How to Turn Your Cash Flow Around With Cyclemoneyco

Turn Your Cash Cyclemoneyco Around: How to Turn Your Cash Flow Around With Cyclemoneyco management is crucial for any business seeking to thrive in a competitive landscape. Cyclemoneyco offers a suite of innovative tools that can transform your cash flow dynamics by addressing common challenges such as inefficient expense management and prolonged receivables. By leveraging predictive analytics and real-time insights, businesses can identify opportunities for improvement and take proactive steps towards enhanced liquidity. However, the question remains: how can you implement these strategies to not only stabilize but also elevate your financial standing? The answer lies in understanding the specific features and success stories of Cyclemoneyco.

Understanding Cash Flow Challenges

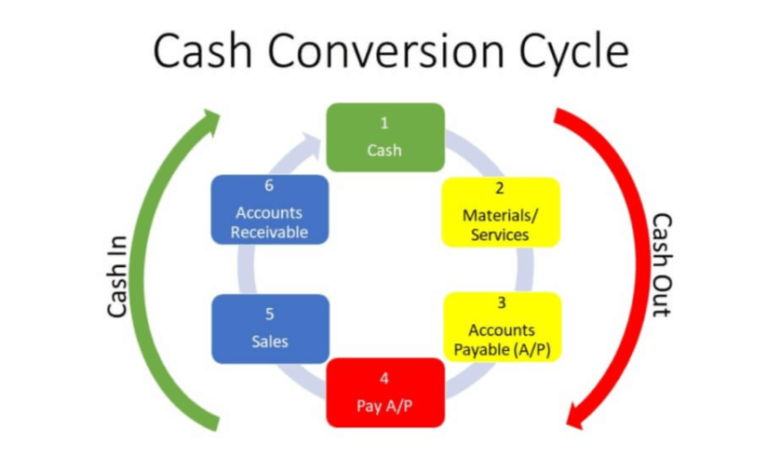

In navigating the complex landscape of business finance, understanding cash flow challenges is paramount for sustained growth and stability.

Effective financial management hinges on recognizing the factors that impact cash flow, such as timing discrepancies between income and expenses.

Features of Cyclemoneyco

Recognizing and addressing cash flow challenges can significantly enhance a business’s financial health, and Cyclemoneyco offers a range of features designed specifically to tackle these issues.

The Cyclemoneyco tools streamline cash management, providing real-time insights and predictive analytics.

These Cyclemoneyco benefits empower businesses to make informed decisions, optimize their financial strategies, and ultimately gain greater freedom in managing their resources effectively.

Read Also Sdec3050rr: Sdec3050rr: Decoding This Digital Code and Its Purpose

Strategies for Cash Flow Improvement

Effective cash flow improvement strategies are essential for businesses seeking to enhance their financial stability and operational efficiency.

To optimize cash reserves, prioritize robust expense management by identifying unnecessary costs and implementing budget controls.

Additionally, consider accelerating receivables and negotiating favorable payment terms with suppliers.

These approaches empower businesses to maintain liquidity, ultimately fostering greater flexibility and freedom in financial decision-making.

Success Stories With Cyclemoneyco

Many businesses have experienced remarkable transformations through the innovative cash flow management solutions provided by Cyclemoneyco.

Real life testimonials highlight significant improvements in liquidity and operational efficiency, empowering companies to make strategic investments.

These business transformations not only enhance financial stability but also promote the freedom to innovate and grow.

With Cyclemoneyco, organizations can truly unlock their potential and thrive in competitive markets.

Conclusion

In conclusion, Turn Your Cash Cyclemoneyco Around: How to Turn Your Cash Flow Around With Cyclemoneyco serves as a pivotal tool for businesses seeking to enhance their cash flow management. For instance, a mid-sized manufacturing firm utilizing Cyclemoneyco’s predictive analytics reported a 30% reduction in outstanding receivables within six months, thereby improving liquidity. By leveraging the platform’s features, organizations can identify inefficiencies, optimize financial operations, and foster a culture of accountability. Ultimately, the integration of Cyclemoneyco fosters sustainable growth and positions businesses for long-term success in a competitive landscape.