The Benefits of Professional Tax Preparation

Introduction

Tax season can be a stressful time for many individuals and businesses. The complex and ever-changing tax laws, the fear of making mistakes, and the time-consuming nature of tax preparation are just a few reasons why many people dread this time of year. However, there is a solution that can alleviate much of this stress: professional tax preparation. Hiring a tax professional to handle your taxes offers numerous benefits, from ensuring accuracy and compliance with tax laws to saving you valuable time and money. In this article, we’ll explore the many advantages of professional tax preparation and why it might be the right choice for you.

Understanding Professional Tax Preparation

Professional tax preparation involves hiring a certified tax expert, such as a Certified Public Accountant (CPA), Enrolled Agent (EA), or a tax attorney, to prepare and file your tax returns. These professionals are trained in tax law, accounting, and financial planning, making them well-equipped to handle even the most complex tax situations. They provide services that go beyond simply filling out forms; they offer strategic advice, help maximize deductions, and ensure that your tax returns are accurate and filed on time.

Accuracy and Compliance with Tax Laws

One of the most significant benefits of hiring a professional for tax preparation is the accuracy they bring to the process. Tax laws are complicated and frequently updated, making it challenging for the average person to keep up. A tax professional stays current with these changes and understands how they apply to your specific situation. This knowledge helps ensure that your tax return is accurate, minimizing the risk of errors that could lead to audits or penalties from the IRS.

Tax professionals also ensure compliance with all relevant tax laws. They understand the intricacies of federal, state, and local tax regulations and how they interact. This expertise ensures that all necessary forms are completed correctly and that you comply with all legal requirements, reducing the risk of legal issues down the road.

Maximizing Deductions and Credits

Another significant advantage of professional tax preparation is the ability to maximize deductions and credits. Tax professionals have an in-depth understanding of the tax code and can identify deductions and credits that you might not be aware of. These could include deductions for business expenses, education, healthcare, and more. By maximizing your deductions and credits, a tax professional can help you reduce your tax liability and potentially increase your refund.

Saving Time and Reducing Stress

Tax preparation is time-consuming and stressful, especially if you have a complex financial situation. Gathering documents, understanding tax forms, and ensuring accuracy can take hours or even days. Hiring a professional to handle your taxes can save you a significant amount of time. This allows you to focus on other important aspects of your life or business.

Moreover, the peace of mind that comes with knowing your taxes are in the hands of a professional is invaluable. You don’t have to worry about making costly mistakes, missing deadlines, or dealing with the IRS on your own. The reduction in stress alone is often worth the cost of hiring a professional.

Access to Professional Advice and Planning

When you hire a tax professional, you gain access to expert advice and financial planning services that go beyond just filing your tax return. Tax professionals can help you plan for the future by offering advice on retirement planning, estate planning, and other financial matters. They can also provide guidance on how to structure your finances in a tax-efficient way, helping you save money in the long run.

For business owners, a tax professional can be an invaluable resource. They can advise on the most tax-efficient way to structure your business, help with payroll and bookkeeping, and ensure that you are taking advantage of all available tax incentives. This level of expertise can make a significant difference in your financial success.

Avoiding Common Tax Mistakes

Filing your taxes on your own can lead to common mistakes that can be costly. Errors such as incorrect calculations, missing forms, or misunderstood tax laws can result in penalties, interest, or even an audit. A professional tax preparer is less likely to make these mistakes, and in the rare case that an error is made, they often offer guarantees or will work with the IRS on your behalf to correct the issue.

Handling Complex Tax Situations

Not all tax returns are straightforward. If you have multiple sources of income, own a business, have investments, or experience a significant life change, your tax situation can become quite complex. Professional tax preparers are equipped to handle these complexities. They understand how to manage various forms of income, handle business taxes, and navigate the tax implications of life events like marriage, divorce, or inheritance.

Representation in Case of an Audit

One of the most intimidating aspects of taxes is the possibility of an audit. If the IRS chooses to audit your return, having a tax professional on your side can be incredibly beneficial. Many tax professionals offer audit support or representation, meaning they will communicate with the IRS on your behalf, provide documentation, and guide you through the audit process. This support can be crucial in ensuring that the audit is resolved quickly and favorably.

The Cost-Effectiveness of Professional Tax Preparation

While hiring a tax professional comes with a cost, it is often a cost-effective investment. The money you save by maximizing deductions and credits, avoiding penalties, and planning your finances more efficiently can easily outweigh the fee for professional tax preparation. Additionally, the time saved and stress reduced are intangible benefits that many find well worth the cost.

Peace of Mind

Perhaps one of the most important benefits of professional tax preparation is the peace of mind it provides. Knowing that a knowledgeable and experienced professional is handling your taxes allows you to rest easy, confident that your tax return is accurate and compliant with all relevant laws. This peace of mind is especially valuable for those with complex tax situations or for business owners who have to juggle multiple financial responsibilities.

The Impact on Business Owners

For business owners, professional tax preparation is not just beneficial—it’s essential. Business taxes are inherently more complex than individual taxes, with different rules, deductions, and deadlines. A professional tax preparer can help ensure that your business complies with tax laws, takes advantage of all available deductions, and avoids costly mistakes.

Moreover, a tax professional can assist with business planning, helping you make strategic decisions that can reduce your tax burden and improve your bottom line. Whether you’re a sole proprietor, a partner in a business, or a corporation, the expertise of a tax professional can make a significant difference in your financial success.

The Importance of Staying Up-to-Date with Tax Laws

Tax laws are constantly changing, with new regulations and updates being introduced regularly. Keeping up with these changes can be challenging for the average person. However, tax professionals make it their business to stay informed about the latest tax laws and how they affect their clients. This ensures that your tax return is always in compliance with current laws, and that you are taking advantage of any new deductions or credits that may be available.

Reducing the Risk of an IRS Audit

One of the biggest fears people have when filing their taxes is the risk of an IRS audit. While the chances of being audited are relatively low, certain factors can increase your risk, such as errors on your tax return, high income, or complex financial situations. A professional tax preparer can help reduce this risk by ensuring that your tax return is accurate, complete, and compliant with all tax laws. They can also advise you on how to avoid red flags that could trigger an audit.

If you are audited, having a tax professional on your side can be incredibly valuable. They can help you navigate the audit process, communicate with the IRS on your behalf, and ensure that the audit is resolved as quickly and favorably as possible.

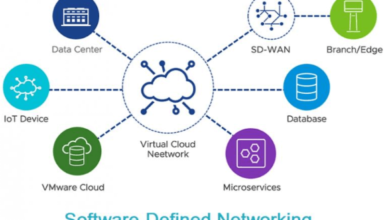

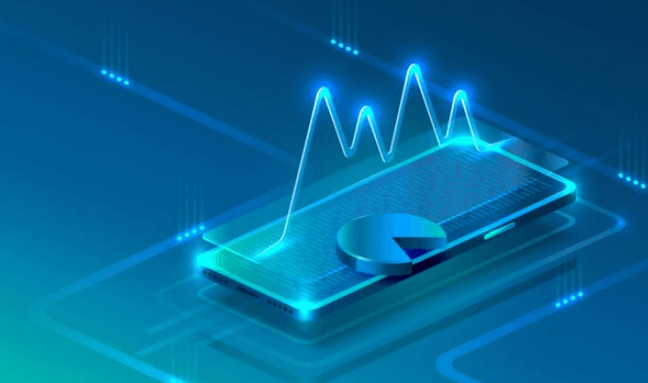

The Role of Technology in Professional Tax Preparation

In today’s digital age, technology plays a significant role in professional tax preparation. Tax professionals use advanced software to ensure accuracy, speed up the preparation process, and identify potential deductions and credits. These tools also help in managing large amounts of data and ensure that nothing is overlooked.

Additionally, many tax professionals offer electronic filing, which is faster and more secure than traditional paper filing. E-filing reduces the chance of errors and ensures that your tax return is processed quickly by the IRS, potentially leading to a faster refund.

Comparing DIY Tax Preparation to Professional Services

Many people choose to prepare their taxes themselves using online tax software. While this can be a cost-effective option for those with simple tax situations, it may not be the best choice for everyone. DIY tax preparation can be time-consuming, stressful, and prone to errors, especially if you have a complex financial situation.

Professional tax preparation offers numerous advantages over DIY methods, including accuracy, expert advice, and peace of mind. For those with complex tax situations or those who simply want to avoid the hassle of tax preparation, hiring a professional is often the better choice.

Choosing the Right Tax Professional

If you’ve decided that professional tax preparation is the right choice for you, the next step is choosing the right tax professional. It’s essential to find someone who is experienced, knowledgeable, and trustworthy. Look for a professional with the appropriate credentials, such as a CPA, EA, or tax attorney. You should also consider their experience with clients in similar financial situations to yours.

It’s also a good idea to ask for recommendations from friends, family, or colleagues and to read reviews or testimonials from previous clients. Taking the time to find the right tax professional can make a significant difference in your overall experience and the quality of service you receive.

The Long-Term Benefits of Professional Tax Preparation

While the immediate benefits of professional tax preparation are clear, there are also long-term advantages to consider. By working with a tax professional year after year, you can develop a relationship that allows them to understand your financial situation better and provide more tailored advice. This ongoing relationship can lead to better financial planning, tax efficiency, and overall financial health.

Additionally, having a tax professional who is familiar with your situation can be invaluable in the event of significant life changes, such as marriage, the birth of a child, or retirement. They can provide guidance on how these changes will affect your taxes and help you plan accordingly.

Frequently Asked Questions

What are the most common deductions that tax professionals find?

Tax professionals often find deductions related to home office expenses, medical expenses, charitable donations, and business expenses. They also help identify less obvious deductions, such as those for job-related education or energy-efficient home improvements.

Can a tax professional help me if I’ve made mistakes on past tax returns?

Yes, tax professionals can assist in amending past tax returns to correct mistakes. They can help you understand what went wrong and work with the IRS to rectify the situation.

How much does professional tax preparation typically cost?

The cost of professional tax preparation varies depending on the complexity of your tax situation and the professional’s experience. However, many people find that the benefits of professional tax preparation, including potential tax savings and peace of mind, outweigh the cost.

Is it worth hiring a tax professional if I have a simple tax return?

Even with a simple tax return, hiring a tax professional can be worth it for the peace of mind and potential savings they can offer. They may also identify deductions or credits you weren’t aware of, which could save you money.

Can tax professionals help with tax planning throughout the year?

Yes, many tax professionals offer tax planning services to help you make tax-efficient decisions throughout the year. This can include advice on retirement planning, investments, and other financial matters.

What should I bring to my first meeting with a tax professional?

For your first meeting with a tax professional, bring all relevant financial documents, including W-2s, 1099s, last year’s tax return, and any receipts or records of deductions. Having this information ready will help the tax professional understand your financial situation and provide the best advice.

Conclusion

The benefits of professional tax preparation are numerous, from ensuring accuracy and compliance with tax laws to saving time and reducing stress. Whether you’re an individual with a straightforward tax situation or a business owner with complex financial responsibilities, hiring a tax professional can provide peace of mind, potential tax savings, and valuable financial advice. As tax laws continue to evolve, the expertise of a tax professional becomes increasingly important. By investing in professional tax preparation, you can confidently navigate tax season and focus on what matters most to you.